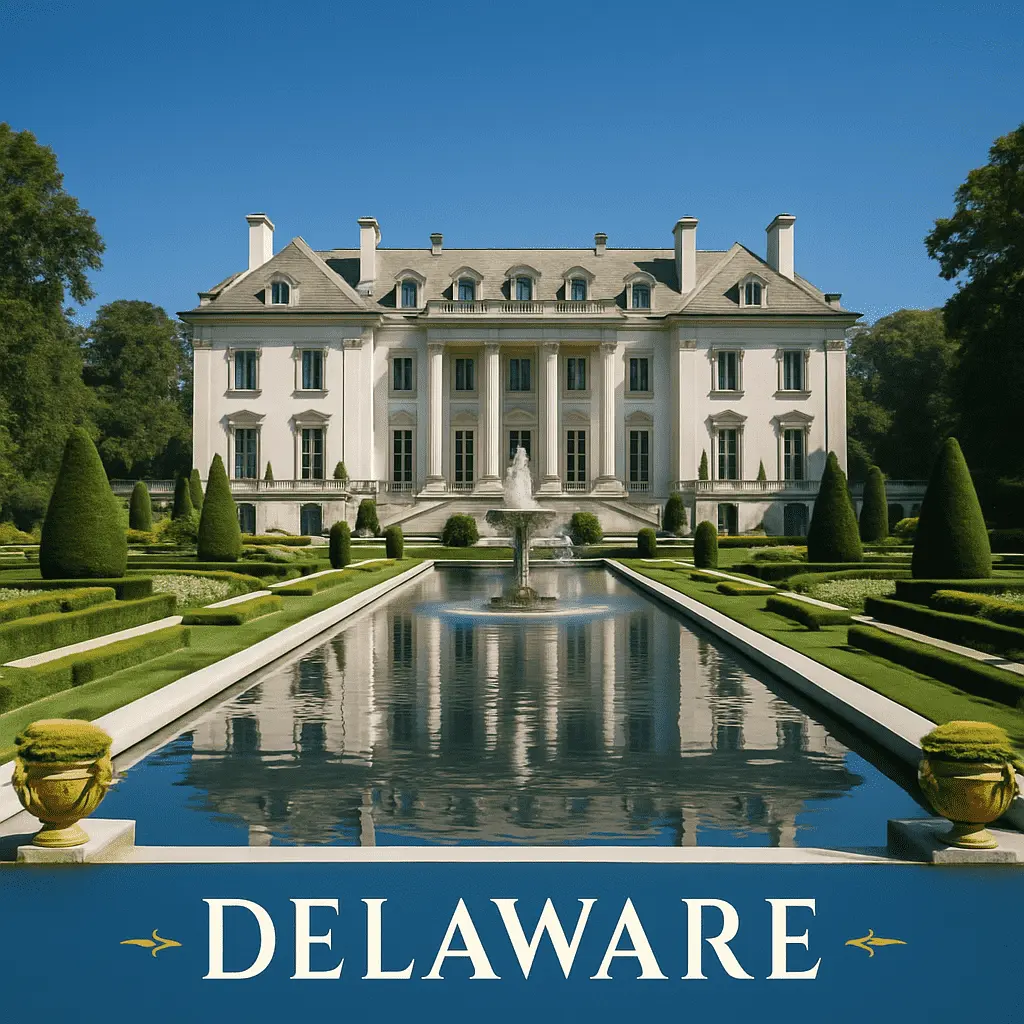

Top U.S. States for Company Registration

Wyoming

Delaware

Missouri

Nevada

Utah

California

Required Documents for U.S. Company Registration (LLC & Inc.)

1,Company Name

You need to provide an English name that is not already taken by an existing company in the state of registration. The name usually must end with:

LLC: e.g., “ABC Consulting LLC”

INC: e.g., “XYZ Trading Inc” or “XYZ Corporation”

You can provide multiple alternative names for availability checks.

2,Business Purpose

Briefly describe the type of business your company plans to engage in, such as e-commerce, software development, international trade, consulting services, etc. Most states accept a “general purpose” description, for example: “To engage in any lawful business in the state of XXX.”

3,U.S. Registered Office Address

Must be a physical address within the United States; P.O. Boxes are not allowed. This address is usually provided by the registered agent (especially if you are located overseas).

4,Registered Agent Information

All U.S. companies must designate a “registered agent” in the state of registration to receive government or court documents. You can use a professional registered agent service (annual fee typically $50–$150). If you have a friend or office locally, they can also serve as your registered agent.

5,Company Members / Shareholders Information

For LLCs: provide information about members or managers.

For Corporations (INC): provide information about shareholders, directors, and senior officers (e.g., President, Secretary).

Required information includes: full name (in English), nationa

6,Identification Documents

For company principals or shareholders: a scanned copy of the passport main page (non-U.S. residents usually use passport).

If opening a U.S. bank account, an additional proof of address in English may be required (e.g., utility bill or driver’s license).

7,Contact Information

Include email address, phone number (Chinese numbers are acceptable), and a backup email (for receiving government notices, etc.).

8,Company Operating Agreement or Bylaws

LLCs need to draft an Operating Agreement.

INCs need to draft Bylaws.

These documents are not mandatory for registration but may be requested by banks or government agencies during account opening, tax filing, annual reports, etc.

9,Information Needed for Tax ID (EIN) Application (if applicable)

If you want us to handle the EIN application after company registration, please prepare the following additional information:

One company principal’s tax responsible person information (usually the majority shareholder)

Passport details;Date of birth;Signed authorization form (such as Form SS-4);You can apply without SSN/ITIN (paper application required)

Comparison of Tax Rates in Popular States for Registration

1,Wyoming

Corporate Income Tax: 0%. Wyoming has no corporate income tax, making it one of the most tax-advantageous states in the U.S.

Sales Tax: State sales tax is 4%, with local governments able to add up to 2%, for a maximum combined rate of 6%.

Franchise Tax: None.Annual Report Fee: Minimum $60. The fee is calculated based on the total value of company assets in Wyoming (charged at $0.0002 per $1,000 of assets).

2,Delaware

Corporate Income Tax: 8.7%, applied to companies conducting business in Delaware.

Sales Tax: 0%. Delaware does not impose sales tax.Franchise Tax: Yes. Companies must pay franchise tax, calculated by two methods: minimum $175 (can reach up to $250,000 for large or high-valued companies).

Annual Report Fee: For C-Corp, $50 annual report fee; LLCs pay a $300 annual fee with no report required.

3,Missouri

Corporate Income Tax: 4% (reduced to this rate since 2020, relatively low).Sales Tax: State sales tax is 4.225%; with local taxes added, the total usually ranges between 6% and 10%.Franchise Tax: Abolished since 2016; no franchise tax currently.

Annual Report Fee: C-Corps must file annual reports, fee is $45 (electronic) or $50 (paper); LLC annual requirements are lower and some types may be exempt.

4,Nevada

Corporate Income Tax: 0%. Nevada does not impose corporate income tax.Sales Tax: State rate is 6.85%, with local additions, totaling up to approximately 8.375%.

Franchise Tax: No traditional franchise tax, but businesses must pay an annual business license fee and annual list fee.

Annual Report Fee: For C-Corp or LLC: Annual List (list of directors and officers): $150; Business License Fee: $500 (corporations) or $200 (LLCs).

5,California

Corporate Income Tax: 8.84% (C-Corp), 1.5% (S-Corp).Sales Tax: State rate is 7.25%; some cities/counties impose additional taxes, total can reach 8.5% to 10.5%.

Franchise Tax: LLCs pay an annual franchise tax:Fixed fee of $800/year; if annual gross income exceeds $250,000, additional graduated fees apply.

Annual Report Fee:LLCs: $800 annual franchise tax (can be waived the first year) plus $20 statement fee.Corporations: Must file Statement of Information with a $25 fee.

6,Utah

Corporate Income Tax: 4.65%, flat rate applied to company net income.Sales Tax: State rate is 4.85%; with local taxes, total sales tax is about 6% to 8%.

Franchise Tax: No traditional franchise tax, but annual report fees apply.Annual Report Fee: Companies and LLCs must file annual reports: Corporation: $18 fee;LLC: $20 fee

Why Choose Us?

✅15+ Years of U.S. Tax & Business Experience

Trusted by thousands, we specialize in helping international founders navigate U.S. company formation and compliance.

✅Bilingual Support (English & Chinese)

Seamless communication—our bilingual team ensures nothing gets lost in translation.

✅All-in-One Compliance Services

From company formation to EIN, BOI filing, annual reports, and tax returns—everything handled in one place.

✅Foreign Founder Friendly

No SSN? No U.S. address? No problem. We simplify the process for non-U.S. residents and overseas entrepreneurs.

✅Real U.S. Business Address & Registered Agent

All packages include 12 months of real address service and official mail scanning—no hidden costs.

✅Transparent Pricing with Lifetime Support,Clear, upfront pricing,no hidden fees

How to Choose Your U.S. Company Type: LLC or Inc?

Chinese clients often ask: as a Chinese national, should I register an LLC or a C Corporation (Inc) in the U.S.? Many believe LLCs are simpler and more flexible. However, for non-resident Chinese entrepreneurs and investors, a C Corporation is often more advantageous—even with its “double taxation” feature. Here’s why:

LLC Considerations:LLCs are pass-through entities—profits pass directly to members and are taxed on their personal returns. But for non-resident Chinese, this means:

Must apply for an ITIN;File Form 1040-NR (non-resident tax return);pay tax on profits even if not distributed (due to “constructive receipt” rules)

Face complex IRS compliance, including forms W-8BEN, W-8ECI, etc.

Advantages of C Corporation (Inc):

Though C Corps face corporate tax plus dividend tax (“double taxation”), Chinese shareholders usually can avoid or reduce this burden.

Separate Tax Entity: The company pays corporate tax (Form 1120). Shareholders not receiving dividends or providing services in the U.S. usually don’t owe U.S. personal tax or file Form 1040-NR.

No ITIN or Non-Resident Filing Hassles: No need to get ITIN for every foreign shareholder or file personal returns, simplifying banking and payment platform approvals.

Better for Fundraising and Equity: C Corps are the standard for U.S. startups, allowing stock issuance, stock options, ESOPs, and easier VC funding or IPO paths.

Reduced Dividend Withholding Tax: Thanks to the U.S.-China tax treaty, dividend withholding tax can be lowered from 30% to 10% with Form W-8BEN.

The table below summarizes key differences and tax benefits of each company type:

| Features | LLC | C Corporation | S Corporation | Sole Proprietorships |

|---|---|---|---|---|

| Tax Form Types | Form 1065 | Form-1120 | Form 1120-S | Form-1040 and Schedule C + Schedule SE |

| Tax Structure | No company tax; tax passed to members | Chinese shareholders; company taxed, no individual U.S. tax filing | No corporate tax; individuals taxed on income | Pay personal income tax |

| Number of Shareholders | No limits | No limits | Up to 100, all U.S. citizens | Sole individual |

| Share Structure | No shares; flexible profit distribution | Multiple classes of shares | Single class of shares | No shares issued |

| Shareholder Status | No nationality restrictions | No nationality restrictions | U.S. citizen | No nationality restrictions |

| Common Misconceptions | LLC simple taxation | Double taxation | S Corp better tax savings | No tax obligation |

Steps to Register a U.S. Company:

Step 1: Choose Company Type and State

Select the appropriate company type and registration state based on your business needs.

Step 2: Confirm Company Name

Check name availability on the state Secretary of State website. Name must comply with state rules and include suffixes like “LLC” or “Inc.”

Step 3: Appoint Registered Agent

Every company must have a registered agent with a physical address in the state to receive legal documents. This can be an individual or a service company.

Step 4: File Formation Documents

Submit formation documents to the Secretary of State, including company name, registered agent, address, management structure, and pay the state fees.

Step 5: Draft Bylaws or Operating Agreement

Prepare internal governance documents. Not mandatory in all states but recommended to regulate company management.

Step 6: Obtain Business License and EIN

Get necessary business licenses and apply to the IRS for an EIN (Employer Identification Number), which serves as the company’s tax ID.

The document You will Get After Registered

Business License: This is the official certificate issued by the state government confirming the company’s legal registration.

Articles of Incorporation: A legal document that certifies the formation of the company and is filed with the state authorities.

Certificate of Organization: This document applies to LLCs and serves as proof of the company’s lawful establishment.

Employer Identification Number (EIN): A tax identification number required for tax filing, hiring employees, and opening business bank accounts.

Operating Agreement: This document defines the rights, responsibilities, and profit distribution among LLC members (applicable only to LLCs).

Corporate Bylaws: Internal rules governing the management of C-Corporations or S-Corporations, including the duties of shareholders and the board of directors.

Initial Meeting Minutes: Records of the key decisions made during the company’s formation meeting.

Stock Certificates: Proof of ownership of company shares, applicable to C-Corporations and S-Corporations.

Frequently Asked Questions